Finance and Investment Report

for the year ending 30 June 2025

Background

This past year has shown continued significant activity within Rhodes House, with Scholars, Scholar alumni, visitors to the Trust, and commercial guests all continuing to enjoy the world class facilities and services of the House. A wide range of events, from small personal Scholar Fireside Chats, to private dinners, gala dinners, University events, and large scale commercial conferences have benefitted from the investment the Trust has made in the facilities. In its second full year of activity, Rhodes House Ltd, the trading subsidiary that manages all event and accommodation activity, has delivered turnover of £3.4m and absorbed £1m of indirect, overhead cost. We continue to be very proud of this achievement, and excited by the opportunities ahead to further develop this source of income to support the scholarships.

During the year, the Rhodes Trust’s invested assets have held their value in a volatile market, and stand at £422 million. An additional £80 million is held on behalf of the Atlantic Institute in a separately managed portfolio, currently being spent down over the life time of the Institute. The total net asset value of the Rhodes Trust is £548 million at 30 June 2025.

The return from the endowment covers the University fees, stipends and other direct Scholar costs, and the overheads that support the Scholarship programme. The partnership activities (Atlantic Institute, Schmidt Science Fellows, Rise) are funded either from ring-fenced restricted funds, or flow funded in advance on a quarterly basis. The return from endowment is supplemented significantly by the Scholars Fund, by income from the matched funding arrangements that were established with co-funding Colleges and Oxford University during the last, and the current, fundraising campaigns and, increasingly, by the profits generated by Rhodes House Ltd. Rhodes House Ltd is the trading subsidiary that manages the conference, events and accommodation operations of Rhodes House.

Governance

In addition to the oversight of the Trustee Board, three committees are directly involved in the management of the Trust’s resources:

- Finance & Investment Committee (budget setting and invested asset management);

- Audit & Risk Committee (risk review and the annual external audit); and

- Remuneration Committee (staff salaries and benefits)

At every Board meeting, the Trustees monitor a schedule of key performance indicators across all aspects of the Trust’s operations. The Trust prepares statutory accounts under the UK Charity SORP (FRS102), which are subject to annual external audit and filed with the UK Charities Commission. These are also available on the Trust's website.

Scholar Costs, Endowment and Capital Campaign

The Trust spent £27.7m million on the Rhodes Scholarships in the year ended 30 June 2025. The Trust’s overall operational turnover includes a further £27.5 million of fully recovered expenditure relating to the partnership programmes.

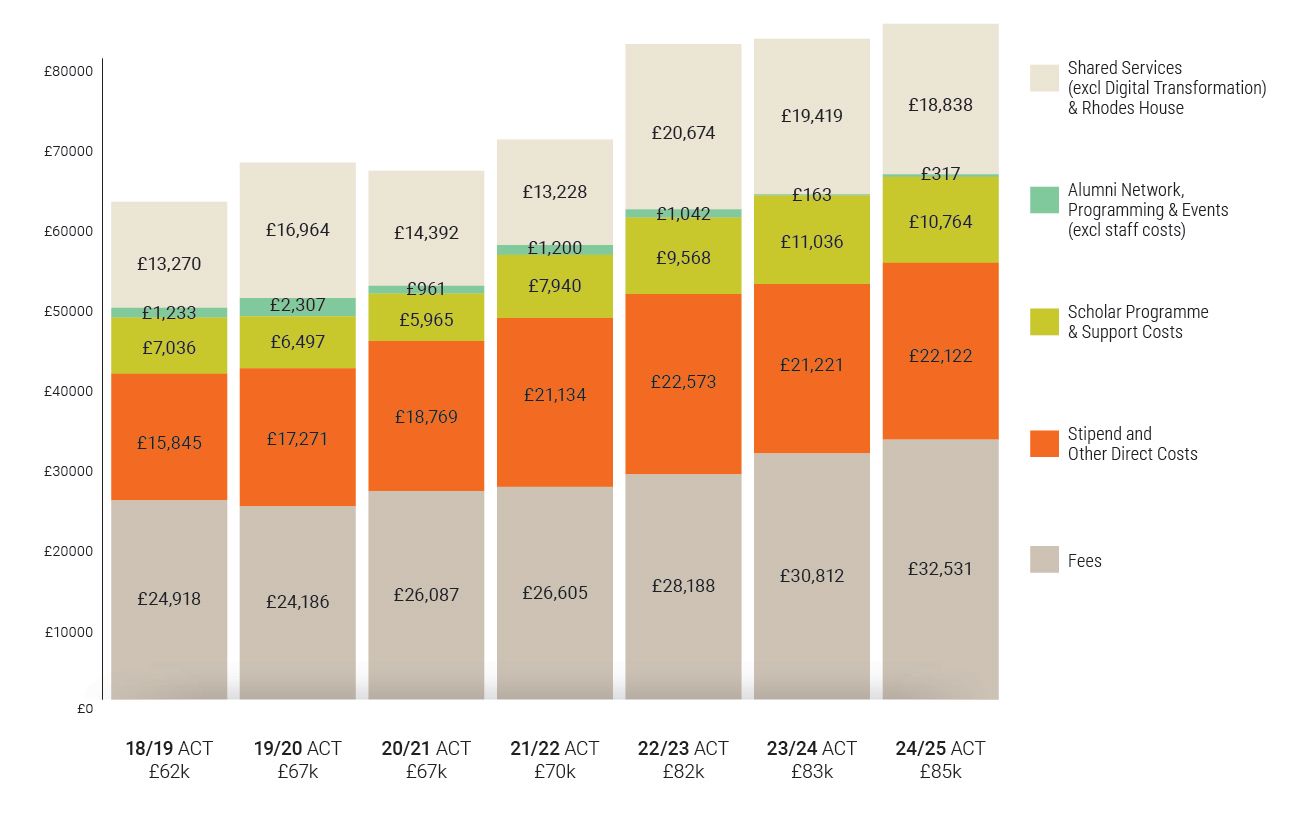

Rhodes Scholarship specific expenditure was funded primarily by the allocation of investment returns to income of £22 million (as governed by the spending rule) and £1.3 million from the Scholars Fund. The balance is funded by other charitable income. Approximately 54% of Rhodes scholarship expenditure is on direct Scholar costs (including fees and stipends) and a further 11% on programming and Scholar support services. After fully allocating all expenses (except fundraising costs), the Trust spent approximately £85k per Scholar in the year ended 30 June 2025 (see Figure 1).

Figure 1 Gross Average Cost per Scholar

Figure 1 Gross Average Cost per Scholar

264 fully funded Scholars in Residence were in Oxford in the academic year 2024/25, with a further number that were part-funded. The Trust awarded 105 Scholarships for the 2025/26 cohort.

Staff Cost Management

Central Shared Services staff offer professionally managed services in the areas of financial operations and reporting, HR, IT and estates management, both to the partnership programmes as well as to Rhodes House and the Scholarship programme. The contribution made by the partnerships to support these services was £1.2 million in y/e 30 June 2025.

Endowment Status

The Pooled Endowment Investment Portfolio is overseen by the Rhodes Trust Finance & Investment Committee, which is comprised of Trustees and other members drawn from the finance community.

As of 30 June 2025, pooled investment assets supporting the Scholarships were valued at £422 million, which represents a small decrease of £3 million since 30 June 2024. This movement reflects the addition of £9.5 million of donations invested during the year, £10.6 million transferred out to the Atlantic ring-fenced portfolio, £25.4 million of funds withdrawn under the spending rule to support expenditure, and £21.4 million of net realised and unrealised gains on investments.

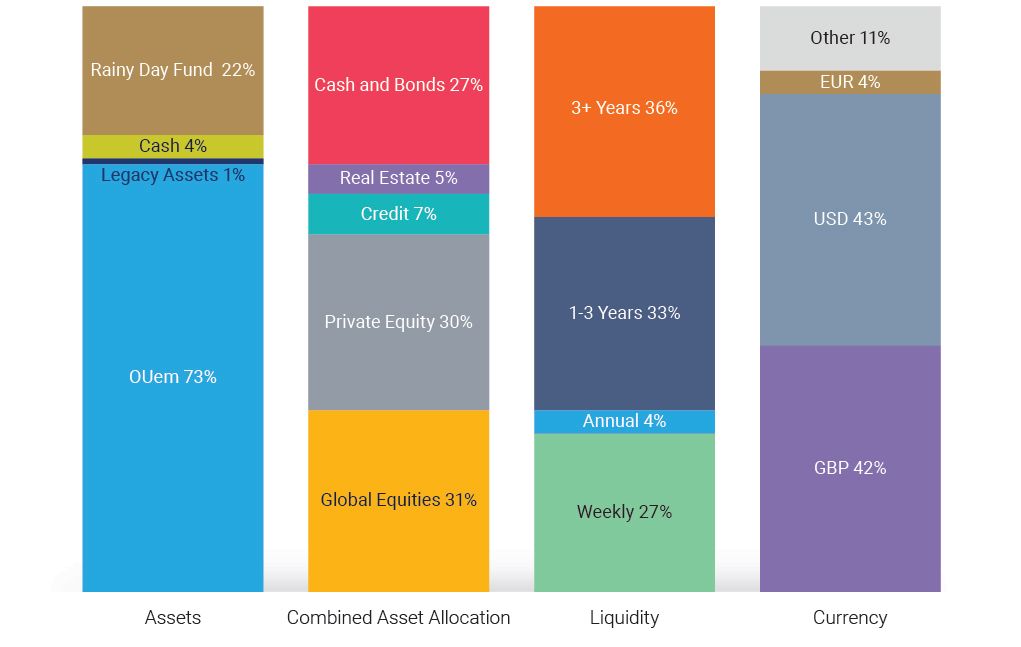

As of 30 June 2025, 73% of the Trust’s Scholarship endowment assets were managed by Oxford University Endowment Management (OUem) in a globally diversified, strategic asset allocation-based portfolio. A Rhodes Trustee is currently on the Board of OUem. The balance is held in a sustainably managed fund with Barclays PLC, providing greater control over asset allocation and liquidity.

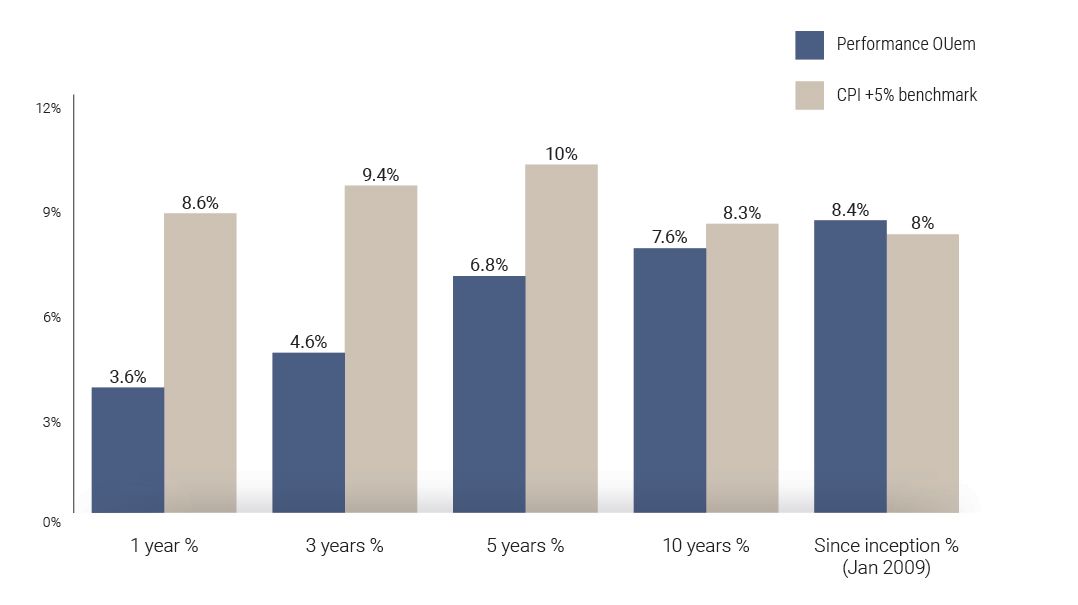

Figure 2 OUem performance over time

Figure 2 OUem performance over time

Figure 3 Combined asset allocation, liquidity and other exposures

Figure 3 Combined asset allocation, liquidity and other exposures

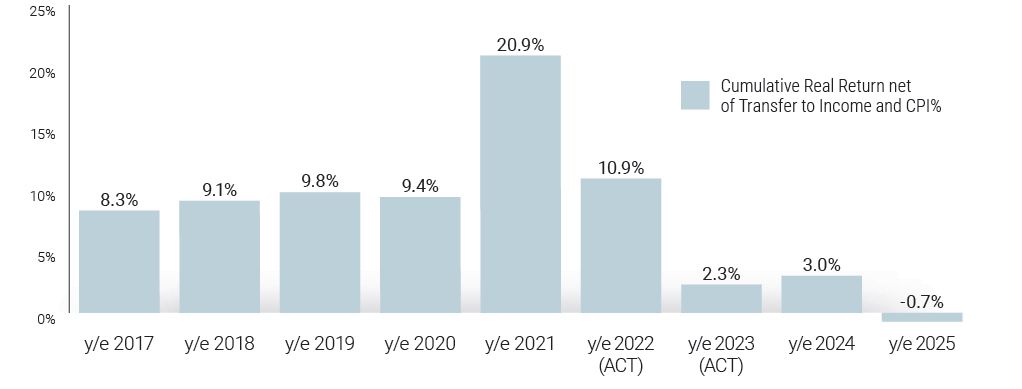

Figure 4 Cumulative Real Return net of Transfer to Income (reflecting ACTUAL inflation) %

Figure 4 Cumulative Real Return net of Transfer to Income (reflecting ACTUAL inflation) %

Investment Performance

OUem’s performance for the year ended 30 June 2025 was 3.6%, which was modest relative to our goals, but reflected currency head winds. Figure 2 outlines OUem’s performance over time. Figure 3 shows the Trust’s combined asset allocation, liquidity and other exposures.

Figure 4 shows the cumulative effect over the last nine years, replacing CPI with the actual inflationary rate experienced by the Trust (on Scholar stipends, staff costs, fees etc). The negative cumulative position supports the recognised intention of the Trustees to work towards a reduction in the planned transfer to income from the endowment (the ‘take rate’).

The policy of the Trust continues to be to fully endow all new Scholarships and to strengthen the endowment of the core Scholarships that are currently funded mostly by endowment, but which depend on the annual giving support of our donors.

Whilst the primary purpose of Rhodes House is to support Scholar activity, the Trustees are pleased to see the continued growth and development of the commercial activity of the conference, event and accommodation centre, and the significant contribution being made to the Trust’s operating costs, which include interest of £800k per annum, at a fixed rate of 2.67% on the £30 million bond that was issued in 2018 to fund the building project.

Generous gifts, both recent and earlier gifts to our endowment, continue to generate the returns that fund the Trust.

We remain grateful for your continued support.

Peter Stamos

(California & Worcester 1981)

Chair of the Finance and Investment Committee

Julia Palejowska

Finance Director

1 November 2025